I recently rented out an apartment to a new tenant. I created the lease online using Zillow. While Zillow does include mandatory notices and includes a credit score and background check service, it doesn’t mention anything about recommending landlords get certain personally identifying information (PII) that can be critical in helping landlords if a tenant decides to stop paying rent.

In one of my rentals, I inherited a tenant who, after a few years, couldn’t pay the rent. Despite trying to work with her, she clearly knew that she could stay just stop paying and stay in the apartment until she is served a formal eviction notice by the sheriff. Due to court backlogs, it would be about 2 months before the sheriff could serve her, and there was nothing I could do about it. I eventually lost around $5000, but at least I was able to renovate the apartment and rent it out for $500 a month more. Nevertheless, the carelessness of the tenant, who thought she could rip me off, was disturbing, as California law is too lenient on renters. Fortunately, I found a way that could either get the former tenant to pay her debt or suffer the consequences of her non-payment being recorded in her credit history. However, you can’t report your tenant to the credit bureaus unless you have enough information, including their date of birth. Since I didn’t have all that information, I had to do some investigative work using Instant Checkmate and Ancestry.com. With Instant Checkmate, I was able to find all sorts of information about my former tenant, including the fact that she had filed for bankruptcy and had been evicted in the past. Instant Checkmate looks like a super shady website, but luckily, it’s not. With Ancestry.com, I was able to get her date of birth, which is required in order to report people to the credit bureaus. With this information, along with signed copies of the lease and other details, I used a service called FrontLobby to go after my former tenant.

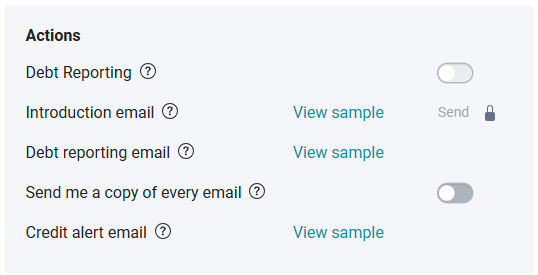

FrontLobby can be used to report current tenants to the credit bureaus when they pay late or don’t pay at all. It can also be used to report former tenants.

New / Existing Tenants

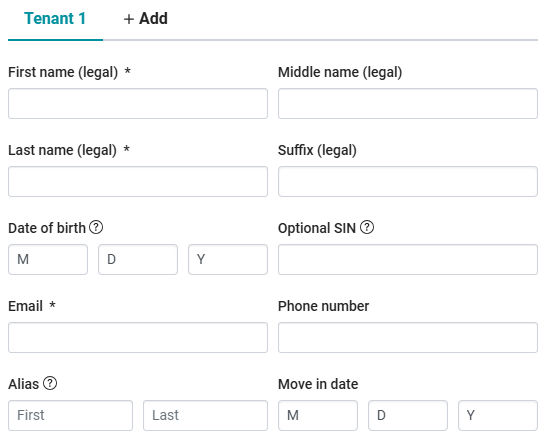

If you will have a new tenant, make sure you get the following information from them before they move in:

- Legal first, middle, and last names

- date of birth (required in order to report people to the credit bureaus

- social security number (for more accurate reporting)

- phone number

- aliases, if any.

I would make a copy of their social security card and driver’s license.

You can then inform your new and existing tenants that you will use FrontLobby to track their rent payments and to automatically notify the credit bureaus if they are late. This should make tenants become more motivated to pay on time. You can also inform tenants that if they pay on time, that could help improve their credit score.

Former Tenants Who Are Delinquent

If your tenant has already moved out and they owe your rent, you can use FrontLobby to report their debt to the credit bureaus.

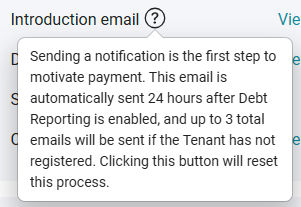

FrontLobby will first email them an introduction to encourage them to pay their debt.

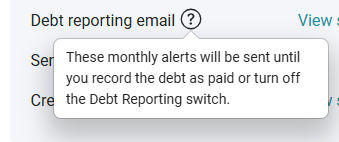

FrontLobby will send the former tenant up to 3 introduction emails. If the former tenant doesn’t register with FrontLobby, FrontLobby will send monthly emails informing the former tenant that their credit score will continue to be affected until they pay.

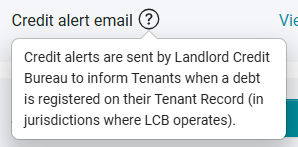

Lastly, if the former tenant still doesn’t pay, then they will get an email alerting them that their debt has been registered with the credit bureaus.

Once you activate debt reporting, you’ll see a notice like this: