Average rate of return

- Stock Market: 10% (before inflation). 7% (after inflation)

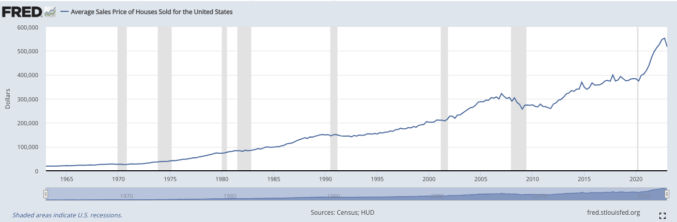

- Real Estate: 10% (especially in the San Francisco Bay Area)

ROI based on own money or borrowed money

- If you invest $100,000 in stocks, with a 10% ROI, you’ll get $10,000 at the end of year one.

- If you invest $100,000 in real estate (20% of a $500,000 house), with a 10% ROI, you’ll get $50,000. Your ROI is based on the value of the property ($500K), not your $100K down payment. Most of your ROI comes from borrowing $400,000 from the bank.

Of course, you can also borrow $400,000 and dump it all into buying stocks but

- no one, especially a bank, would lend you $400,000 to invest in stocks, and even if they did, the interest rate would be more than 10%, causing you to lose money

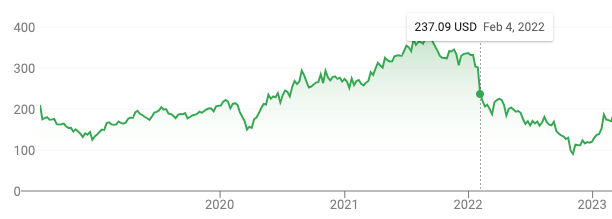

- unless you invest in something like index funds, investing in individual stocks is more risky because their values can plummet in very short periods of time, e.g. Facebook dropped by 26.4% in just one day. A single-day devaluation like that would never happen in real estate. Real estate depreciation can occur, but it would take at least months.

Saving Money Every Month

- If you put aside money every month, e.g. $500, for retirement or tuition for your kids, you’ll have less money every month to spend.

- If you buy a rental property and rent it out, the rent money you collect should pay for the mortgage and expenses. This is akin to saving money, except the renters are saving money for you – you don’t have to put aside money from your paycheck. You may even make a profit every month if your expenses are low. In addition, over the long term, the rental property will also appreciate in value. In this way, you benefit financially in three ways

- from paying down the principal in your mortgage

- from monthly profits after paying all expenses

- from appreciation of your house

Renting vs Owning

- With renting, you lose all the rent money and the rent goes up every year or so.

- With owning, you only lose the mortgage interest you pay, and even so, mortgage interest is tax-deductible. A bulk of the monthly payments you make go into equity to pay down your loan. This is also akin to saving money and doesn’t even include the appreciation of the house. Plus, with owning, you get a bigger space that you can customize (home improvement) to your liking, which will also increase the property’s value, e.g. bath or kitchen remodel, solar panels, etc.

Living off of an investment

- If you need $100,000 to live every year, then with a 10% ROI, you’d need $1,000,000 invested in the stock market. However, due to inflation, $100,000 in year one will not be worth as much as $100,000 five or ten years later.

- With a real estate investment property, once the property is paid off, the monthly rental income is pure profit (minus relatively minor expenses such as taxes, insurance, etc). Rental property expenses increase with inflation, but your rental income also increases with inflation, which is why investment properties are considered a good hedge against inflation. This doesn’t even include the appreciation of the house itself.

Volatility

- The stock market is much more volatile than real estate and is not a tangible asset. A single influencer’s statements can cause a stock to rise or fall, which would never happen in real estate.

Business Benefits

- Investing in the stock market is not a business

- Investing in real estate rental properties is a business, which can give you many tax benefits.